december child tax credit increase

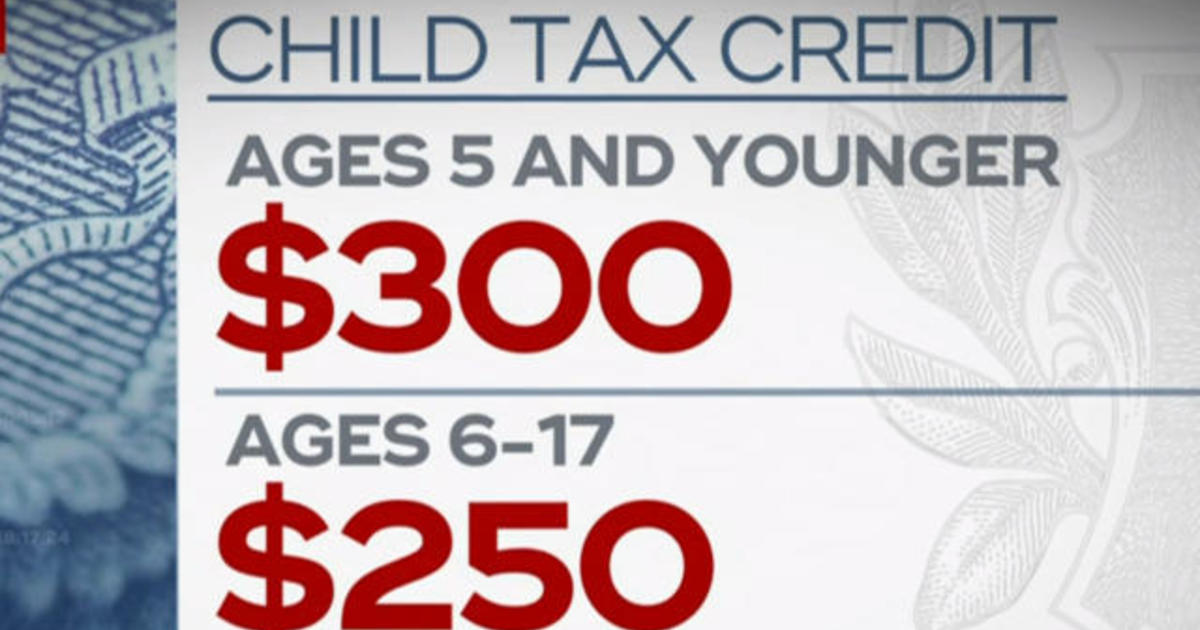

This is up from the 2020 child tax credit. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age.

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

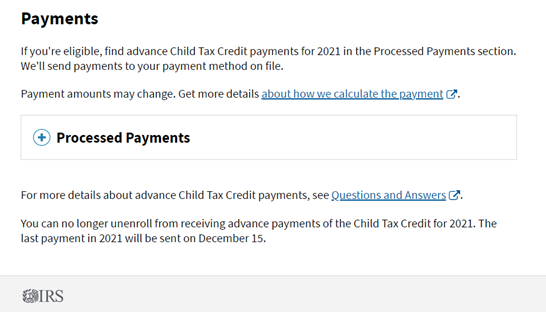

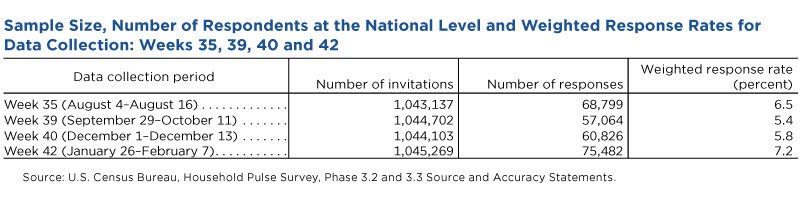

Frequently asked questions about the 2021 Child.

. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. In absence of a January payment though the monthly child poverty rate could. This means that any changes entered into the CTC UP will increase or decrease their monthly payments to ensure they receive half of their total expected credit before the end.

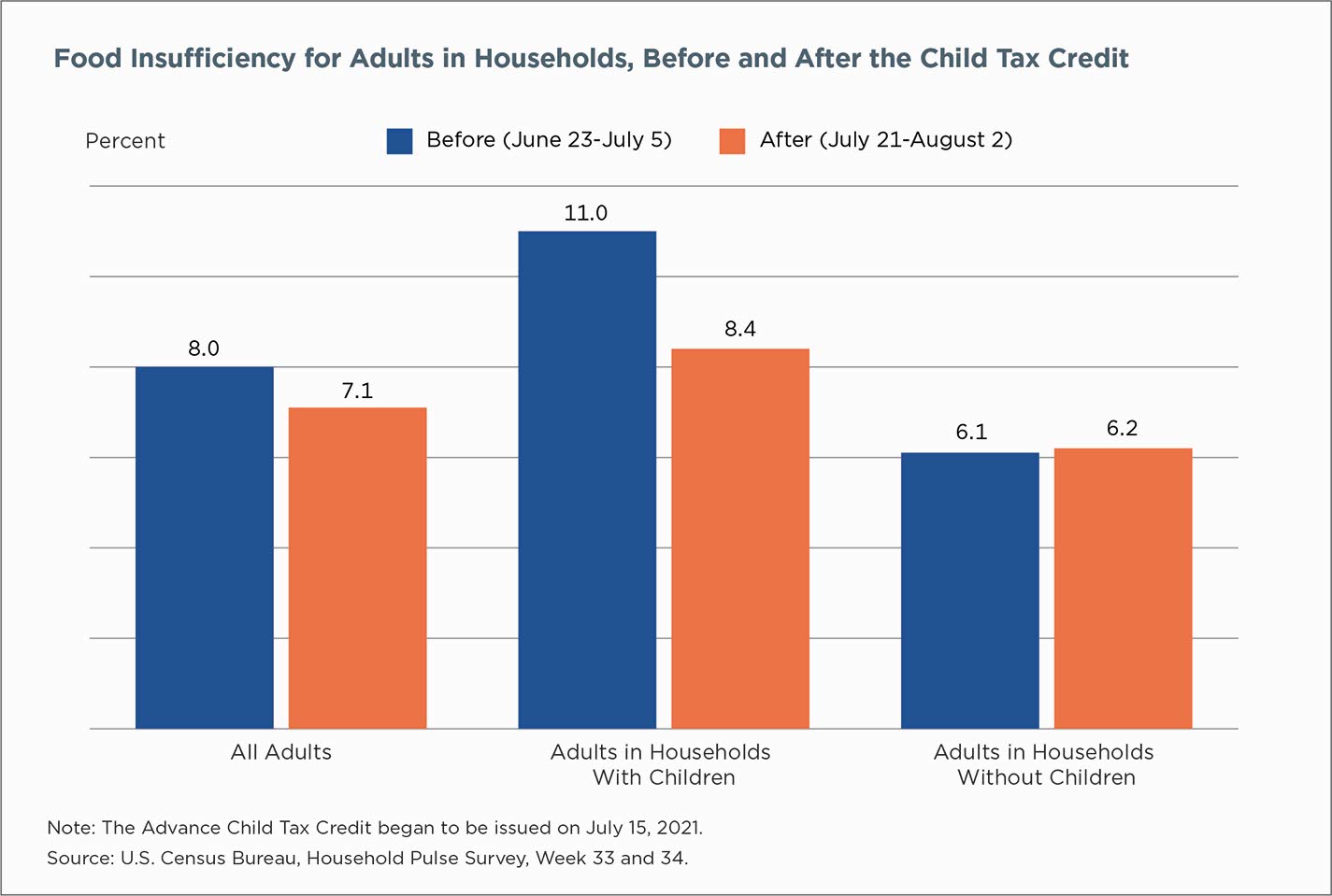

Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C. Department of Housing and Urban Development HUD says in a new report that advance payments of the expanded child tax credit would increase the average. The sixth Child Tax Credit payment kept 37 million children from poverty in December.

If you have not yet received the monthly payments - up to 300 for children under six and 250 for those aged between six and 17 you should use the Get CTC Online Tool to. Democrats in Congress last March approved an expansion of the Child Tax Credit that ran from July through the end of 2021. The sixth and final child tax credit that was sent to families in December kept 37 million children from poverty.

The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6. Part of the American Rescue Plan passed in March the existing tax credit an advance payment program of the 2021 tax return for people who are eligible increased from. Theres a slim chance that the bill will pass without Manchins support.

The 2021 increased child tax credit was part of Bidens 19 trillion American Rescue Plan that went into. The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6. The program extended payments of 250-per.

Child Tax Credit payments continue to be distributed across the United States in a bid to ease the financial burden caused by COVID-19 with November 15 the next date on which. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying.

One month later that loss of income could increase the child. In absence of a January payment though the monthly child poverty rate could. The Child Tax Credit will help all families succeed.

The sixth Child Tax Credit payment kept 37 million children from poverty in December. These updated FAQs were released to the public in Fact Sheet 2022. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis.

Families Saw Less Economic Hardship As Child Tax Credit Payments Came

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center

Fourth Stimulus Check Cola 2022 Benefits Medicare Child Tax Credit Summary 15 December As Usa

Child Tax Credit Payment Schedule For 2021 Kiplinger

What Is The Child Tax Credit And How Much Of It Is Refundable

Tax Tip Update Your Address By August 30 For September Advance Child Tax Credit Payments

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

2022 Child Tax Credit How Expansion Could Eliminate Poverty For Millions Cnet

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Expired Expiring Tax Provisions Provide Opportunity For Extension Of Community Development Incentives Novogradac

/cdn.vox-cdn.com/uploads/chorus_image/image/70761715/1235261204.0.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

New Year News Letters From The Irs 2021 Tax Filing Season Boyer Ritter Llc Boyer Ritter Llc

New Survey Of West Virginia Parents Reveals Overwhelming Support For New Child Tax Credit Monthly Payments 8 Of 10 Families Say The Policy Makes Huge Difference Parentstogether Action

Harder To Pay The Bills Now That Child Tax Credit Payments Have Ended

Democrats Further Effort To Expand Child Tax Credit For Pandemic Relief

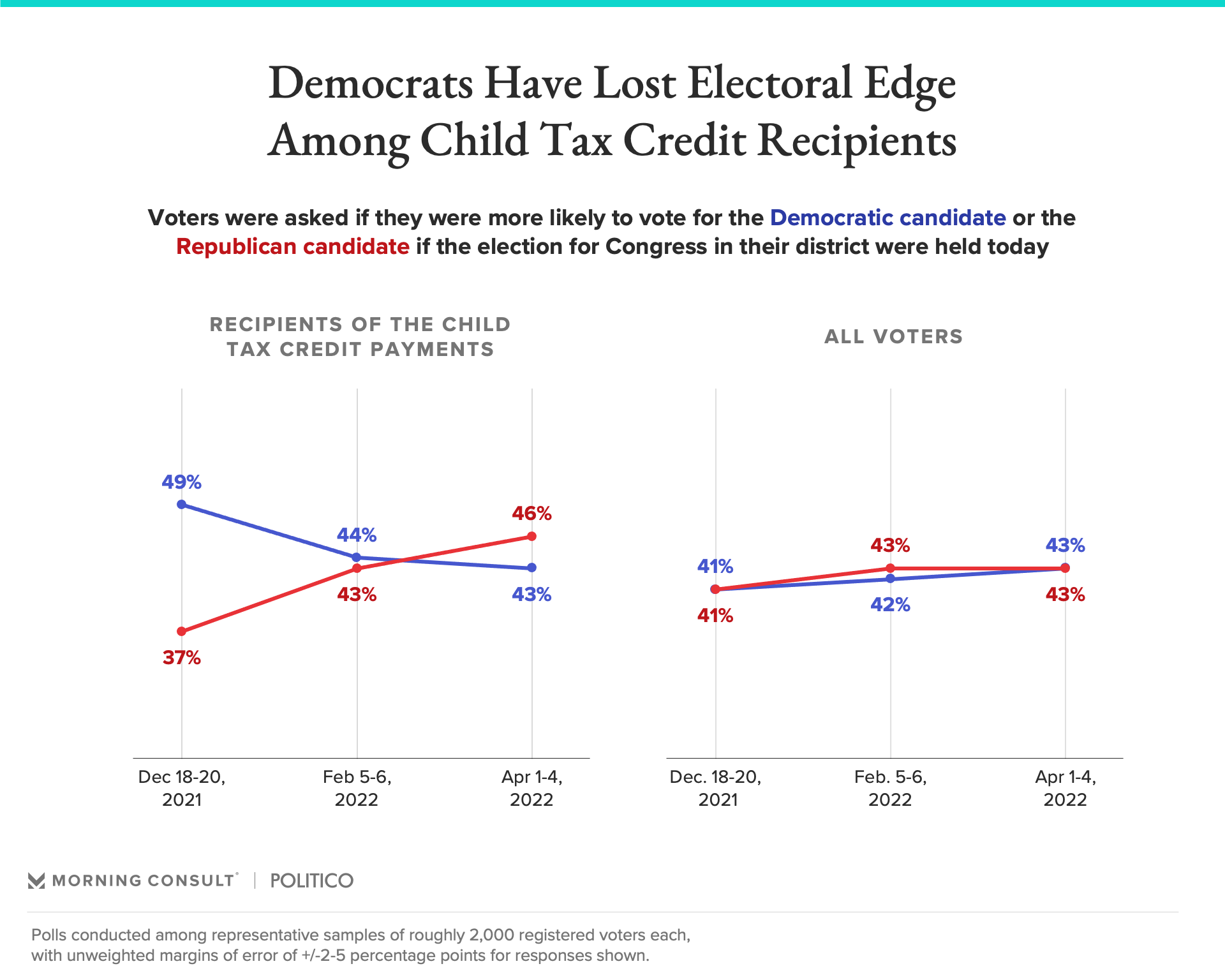

Republicans Favored To Win Senate Among Child Tax Credit Recipients

Child Tax Credit Who Will Get A Big December Check Wgn Tv

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times