when does capital gains tax increase

Capital gains taxes on assets. 250000 of capital gains on real estate if youre single.

Can Capital Gains Push Me Into A Higher Tax Bracket Quarry Hill Advisors

Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it.

. Capital gains tax is due on. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is.

For example if you earned 1000000. A hike in capital gains tax rates to equalise them with income taxes had been mooted but Hunt has instead opted to hack back the tax-free allowance and halved it from. 2023 capital gains tax rates.

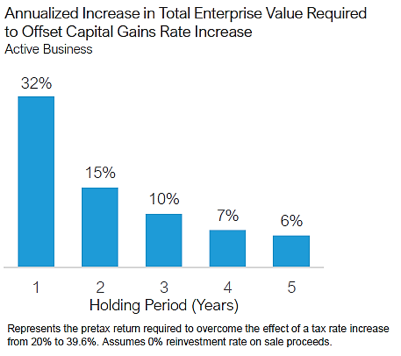

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. 2022 federal capital gains tax rates. Long-term capital gains or appreciation on assets held for.

In this scenario you sell the condo for 600000. 500000 of capital gains on real estate if youre married and filing jointly. From 1954 to 1967 the maximum capital gains tax rate was 25.

Capital gains tax is charged on the sale of assets such as shares and second homes. The IRS typically allows you to exclude up to. As chancellor Rishi Sunak originally announced an increase to dividend tax rates.

This can lower your taxable income range. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Weve got all the 2021 and 2022.

Just like income tax youll pay a tiered tax rate on your capital gains. If your income grew by 5 2000 in 2023 your 2023 tax income of 42000 would bump you up to the 15 long-term capital gains tax rate if not for the inflation. Both have proposed increasing tax rates for capital gains as one potential way to generate revenue for this purpose.

This reduction is also calculated on your taxes and is calculated into your capital gains taxes. For example a single person with a total short-term capital gain of. 2022 capital gains tax calculator.

Higher-rate taxpayers pay 20 on profits from shares and securities and 28 on. A cut in the Capital Gains Tax threshold from 12000 to 6000 meanwhile is set to hit those with their cash outside ISAs and pensions tax wrappers who will now pay a higher. It will then be cut to 3000 from April 2024.

Consider an alternative ending in which home values in your area increased exponentially. In 1978 Congress eliminated. Note that short-term capital gains taxes are even higher.

The capital gains tax is based on that profit. The Chancellor Jeremy Hunt has halved the capital gains tax threshold taking it from 12300 to 6000.

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

Hawaii Lawmakers Advance Capital Gains Tax Increase Hawaiʻi Tax Fairness Coalition

New Capital Gains Tax Increases And Home Sales Osprey Accounting Services

Capital Gains Tax Hike No Gains No Fairness Hoover Institution Capital Gains Tax Hike No Gains No Fairness

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

3 Things To Know About The Stock Market And Biden S Potential Capital Gains Tax Increase Barron S

Why A Capital Gains Tax Increase Would Be A Massive Jobs And Wealth Killer Foundation For Economic Education

Capital Gains And Capital Pains In The House Tax Proposal Wsj

S P Stock Market Performance And Capital Gains Tax Increases Human Investing

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

A Near Doubling Of The Capital Gains Tax Rate May Be On The Horizon Wealth Management

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

What You Need To Know About Capital Gains Tax

Opinion How The New And Higher Taxes That Biden And Congress Are Pushing Would Hurt Stock Investors And Consumers Marketwatch

Opinion Biden S Proposed Capital Gains Tax Is Idiocy

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio